Being Retirement Ready - Smart Investment Guide

The Retirement Reality Check

The contemporary retirement landscape presents unprecedented challenges that demand immediate attention and strategic retirement investment strategy. Traditional retirement security has evaporated, leaving millions of Americans woefully unprepared for their golden years. According to the Federal Reserve’s Survey of Consumer Finances, approximately 40% of Americans have less than $10,000 saved for retirement, while the average retirement account balance hovers around $65,000—a figure that pales in comparison to actual retirement needs.

The demise of defined benefit pension plans has shifted the burden of retirement planning squarely onto individual shoulders. Corporate America has systematically abandoned guaranteed retirement benefits, replacing them with self-directed 401(k) plans that place investment responsibility on employees who often lack the requisite financial acumen. This seismic shift has created a generation of workers navigating complex investment decisions without adequate preparation or guidance.

Longevity trends compound these challenges exponentially. Today’s retirees face the prospect of funding 25-30 years of post-employment life, a duration that previous generations rarely encountered. Medical advances and healthier lifestyles have extended lifespans, but retirement savings strategies haven’t evolved accordingly. The financial implications are staggering: a couple retiring at 65 has a 50% probability that at least one spouse will live beyond age 90, necessitating robust investment portfolios capable of sustaining decades of withdrawals.

Foundational Investment Principles

Time represents the most powerful weapon in implementing a successful retirement investment strategy. Young professionals possess an invaluable advantage: temporal runway that enables compound growth to work its mathematical magic. A 25-year-old contributing $500 monthly to retirement accounts will accumulate significantly more wealth than a 35-year-old making identical contributions, despite the older investor’s higher earning potential and increased contribution capacity.

The mathematics of compounding growth becomes increasingly dramatic over extended periods. Initial contributions may seem insignificant, but their exponential growth trajectory creates substantial wealth accumulation. A $10,000 investment earning 7% annually doubles approximately every ten years, transforming modest early contributions into substantial retirement nest eggs through patient, consistent investing.

Risk tolerance assessment requires honest self-evaluation and realistic expectations about market volatility. Conservative investors who flee to cash and certificates of deposit during market downturns often sacrifice long-term wealth accumulation for short-term emotional comfort. Conversely, aggressive investors who concentrate portfolios in high-risk assets may experience devastating losses that derail retirement timelines.

Dollar-cost averaging provides a systematic approach to market volatility management. Regular, consistent investments regardless of market conditions eliminate the temptation to time markets and reduce the impact of short-term price fluctuations. This methodology ensures investors purchase more shares when prices decline and fewer shares when prices rise, creating a natural averaging effect that smooths investment returns over time.

Tax-Advantaged Account Mastery

The 401(k) represents the cornerstone of most retirement planning strategies, yet many participants fail to optimize these powerful wealth-building vehicles. According to Vanguard’s How America Saves report, employer matching contributions constitute free money that should never be forfeited. Failing to contribute enough to capture the full employer match is equivalent to accepting a voluntary pay reduction—a mistake that costs thousands of dollars annually.

Strategic contribution allocation within 401(k) plans requires careful consideration of current tax situations and future income projections. High earners in peak earning years often benefit from traditional 401(k) contributions that provide immediate tax deductions, while younger workers in lower tax brackets may prefer Roth 401(k) contributions that provide tax-free retirement withdrawals.

Roth IRA conversions present sophisticated tax optimization opportunities for strategic investors. Converting traditional IRA funds to Roth accounts during low-income years or market downturns can provide substantial long-term tax benefits. These conversions require careful timing and tax bracket management but can create significant wealth accumulation advantages for disciplined investors.

Health Savings Accounts offer unparalleled tax advantages that make them exceptional retirement investment vehicles. HSA contributions receive immediate tax deductions, growth occurs tax-free, and qualified withdrawals remain tax-free indefinitely. After age 65, HSA funds can be withdrawn for non-medical expenses with ordinary income tax treatment, essentially functioning as traditional IRA accounts with superior contribution phase benefits.

Self-employed individuals and small business owners can leverage SEP-IRAs and Solo 401(k) plans to accelerate retirement savings beyond traditional employee limits. These vehicles allow substantially higher contribution limits and provide valuable tax deductions for business owners. A profitable consultant or freelancer can contribute up to $70,000 annually through Solo 401(k) plans, dramatically accelerating wealth accumulation compared to standard employee retirement accounts.

Asset Allocation Architecture

Strategic asset allocation forms the foundation of successful long-term retirement investing, determining approximately 90% of portfolio returns according to academic research from Morningstar’s asset allocation studies. Age-based allocation formulas provide useful starting points, with the traditional rule suggesting bond allocations equal to one’s age. However, modern longevity trends and low interest rate environments may require more aggressive equity allocations to generate sufficient retirement income.

Geographic diversification has become increasingly critical as global markets offer attractive growth opportunities beyond domestic borders. International equity exposure provides access to emerging market growth, currency diversification benefits, and reduced correlation with U.S. market movements. Developed international markets offer stability and dividend yields, while emerging markets provide higher growth potential with correspondingly elevated risk profiles.

Sector rotation strategies can enhance returns through tactical allocation adjustments based on economic cycles and market conditions. Technology sectors often outperform during economic expansion phases, while utilities and consumer staples provide defensive characteristics during recessionary periods. However, sector timing requires sophisticated market analysis and can introduce unwanted complexity for typical retirement investors.

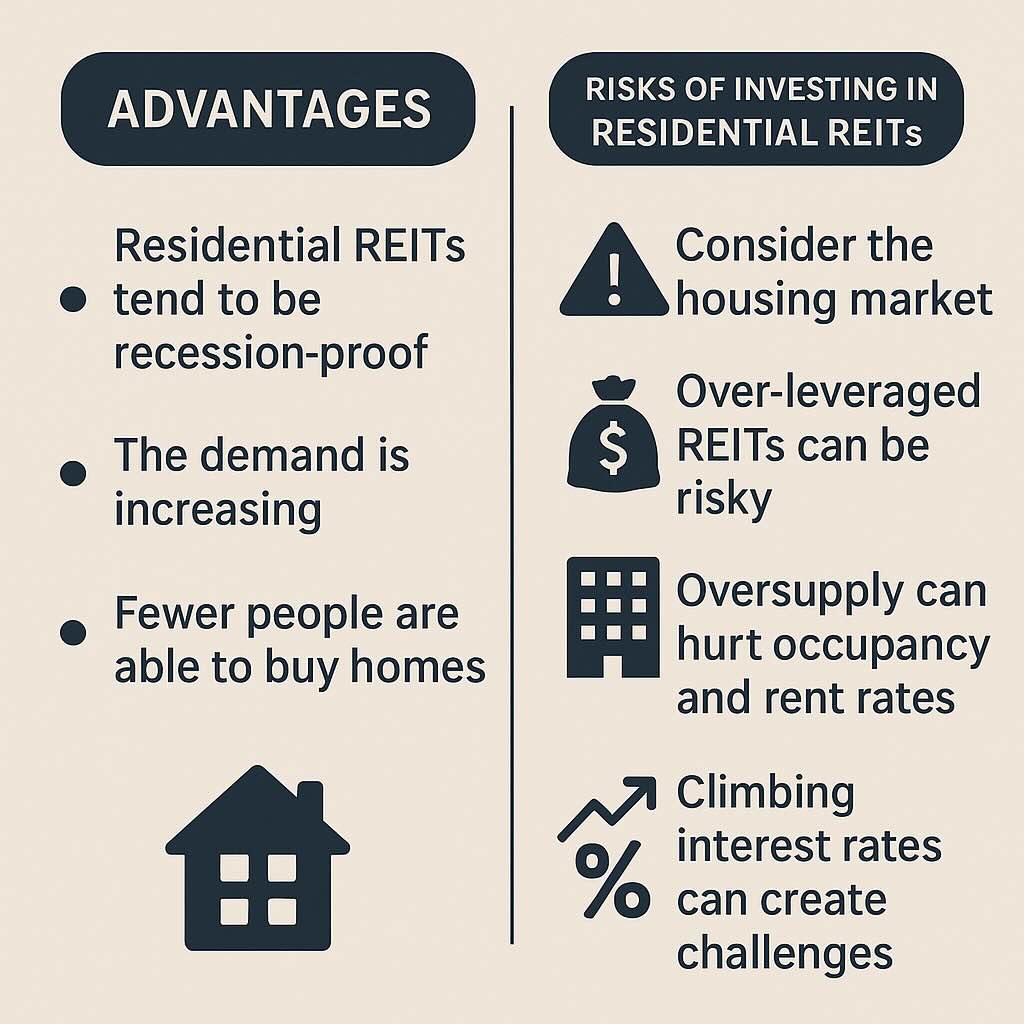

Alternative investments including real estate investment trusts (REITs), commodities, and infrastructure assets can provide portfolio diversification benefits and inflation protection. These asset classes often exhibit low correlations with traditional stocks and bonds, potentially reducing overall portfolio volatility while maintaining competitive returns. However, alternative investments typically involve higher fees and complexity that may not justify their inclusion in smaller portfolios.

Investment Vehicle Selection

Low-cost index funds have revolutionized retirement portfolio management by providing broad market exposure at minimal cost. These passively managed funds consistently outperform the majority of actively managed alternatives over extended periods, primarily due to their ultra-low expense ratios and elimination of manager selection risk. Research from SPIVA reports by S&P Dow Jones Indices shows that total stock market index funds provide comprehensive equity exposure for less than 0.10% annually, a cost structure that preserves significantly more wealth over multi-decade investment horizons.

Target-date funds offer convenient, professionally managed allocation strategies that automatically adjust risk profiles as retirement approaches. These funds provide appropriate diversification and rebalancing without requiring ongoing investor attention or expertise. However, target-date fund selection requires careful evaluation of underlying asset allocation methodologies, expense ratios, and glide path strategies that may not align with individual circumstances.

Individual stock picking represents a seductive but ultimately counterproductive approach for most retirement investors. Academic research consistently demonstrates that individual investors underperform market indices due to behavioral biases, inadequate diversification, and poor timing decisions. Professional money managers with sophisticated resources and analytical capabilities struggle to beat market indices consistently, making individual stock selection inadvisable for typical retirement portfolios.

Bond ladder construction provides predictable income streams and principal protection for conservative portfolio components. Laddering involves purchasing individual bonds with staggered maturity dates, ensuring regular principal repayments that can be reinvested at prevailing rates. This strategy eliminates interest rate risk at maturity while providing steady income throughout the holding period, making it particularly attractive for near-retirees and current retirees.

Advanced Wealth Accumulation Strategies

Tax-loss harvesting enables sophisticated investors to enhance after-tax returns through strategic realization of investment losses as part of comprehensive retirement income planning. This technique involves selling depreciated securities to offset capital gains and ordinary income, potentially saving thousands of dollars annually in taxes. The IRS guidelines on capital losses allow harvested losses to offset up to $3,000 of ordinary income annually, with excess losses carrying forward indefinitely to offset future gains.

Asset location optimization involves strategically placing investments in appropriate account types to minimize tax drag and maximize after-tax returns. Tax-inefficient investments like bonds and REITs belong in tax-deferred accounts, while tax-efficient assets like index funds and individual stocks perform better in taxable accounts. This strategy can add 0.25-0.75% annually to portfolio returns through enhanced tax efficiency.

Rebalancing frequency protocols require balancing transaction costs with portfolio drift management. Quarterly or annual rebalancing typically provides optimal results for most investors, maintaining target allocations without excessive trading costs. Threshold-based rebalancing triggers portfolio adjustments when asset classes deviate beyond predetermined percentages from target allocations, ensuring disciplined buy-low, sell-high execution.

Dividend growth investing focuses on companies with consistent histories of increasing dividend payments over time. These companies typically demonstrate strong competitive positions, excellent management teams, and sustainable business models that generate reliable cash flows. Dividend growth strategies can provide inflation protection and steady income streams that complement traditional retirement investment approaches.

Risk Management and Protection

Emergency fund adequacy calculations must account for potential job loss duration, healthcare expenses, and major home repairs or replacements as part of comprehensive retirement readiness planning. Financial experts typically recommend three to six months of living expenses, but risk-averse individuals or those in volatile industries may require larger reserves. Emergency funds should remain readily accessible in high-yield savings accounts or money market funds, sacrificing investment returns for liquidity and principal protection.

Insurance needs analysis encompasses life, disability, and long-term care coverage that protects retirement accumulation from catastrophic financial events. Term life insurance provides affordable protection during wealth accumulation phases, while disability insurance replaces income if injury or illness prevents continued employment. Long-term care insurance addresses the significant costs associated with extended care needs that can devastate retirement savings.

Market volatility mitigation requires psychological preparation and systematic approaches to inevitable market downturns. Historical analysis reveals that market corrections occur regularly, but long-term investors who maintain discipline through volatile periods consistently achieve superior outcomes. Volatility represents opportunity for patient investors who can purchase additional shares at reduced prices during market declines.

Sequence of returns risk poses particular dangers for investors approaching or entering retirement. Poor investment returns during early retirement years can permanently impair portfolio sustainability, even if subsequent returns prove favorable. This risk necessitates more conservative allocation strategies and flexible withdrawal approaches as retirement approaches.

Retirement Income Planning

Withdrawal rate sustainability models provide frameworks for determining safe retirement spending levels that preserve capital throughout extended retirement periods. The traditional 4% rule suggests retirees can safely withdraw 4% of initial portfolio values annually, adjusted for inflation, without depleting assets over 30-year retirement periods. However, current low interest rate environments and market valuations may require more conservative withdrawal rates of 3-3.5% according to recent research from Schwab Center for Financial Research.

Social Security optimization timing can significantly impact lifetime retirement income through strategic claiming decisions based on Social Security Administration guidelines. Delaying benefits beyond full retirement age increases monthly payments by 8% annually until age 70, potentially providing substantial additional lifetime income for healthy retirees. Conversely, claiming reduced benefits at age 62 may prove optimal for individuals with health concerns or immediate income needs.

Healthcare cost projections reveal that medical expenses typically consume larger portions of retirement budgets as individuals age. Medicare supplemental insurance, prescription drug costs, and long-term care expenses can substantially impact retirement sustainability. Conservative retirement planning should allocate 15-20% of retirement income to healthcare-related expenses, with higher percentages for individuals with chronic health conditions.

Legacy planning considerations involve balancing personal retirement security with wealth transfer objectives. Retirees with substantial assets may choose more conservative withdrawal strategies to preserve inheritances, while those with modest assets should prioritize personal financial security. Estate planning documents, beneficiary designations, and tax-efficient wealth transfer strategies become increasingly important as retirement progresses.

The path to retirement readiness demands disciplined execution of comprehensive investment strategies that evolve with changing life circumstances. Success requires early action, consistent contributions, appropriate risk management, and patient adherence to proven investment principles. The financial independence that enables comfortable retirement doesn’t occur accidentally—it results from deliberate planning and systematic wealth accumulation over decades of diligent investing.

Take Action Today - Your Future Self Depends On It

Stop reading about retirement planning and start doing it. RIGHT NOW.

Every day you delay costs you thousands in lost compound growth. While you’ve been absorbing this information, your potential retirement wealth has been shrinking. The mathematical reality is unforgiving: waiting until tomorrow to start investing costs you exponentially more than starting today.

Here’s your immediate action plan – complete these steps within the next 48 hours:

Don’t let analysis paralysis destroy your financial future. Perfect is the enemy of good – an imperfect investment plan implemented today beats a perfect plan that never gets started.

Open your 401(k) account dashboard and increase your contribution by at least 1%. If you’re not contributing enough to capture your full employer match, fix that immediately. This single action could add $50,000-$100,000 to your retirement balance over your career.

Open a Roth IRA account with a low-cost provider like Vanguard, Fidelity, or Schwab. Automate a monthly contribution of at least $200 – even if you think you can’t afford it. Cancel one subscription service, skip dining out twice this month, or sell something you don’t need. Find the money because your 65-year-old self is counting on your 25, 35, or 45-year-old self to act decisively.

Calculate your exact retirement savings gap using online calculators. Face the brutal truth about where you stand. If you’re behind (and statistically, you probably are), increase your savings rate by 2-3% immediately. Your lifestyle will adjust, but your retirement security depends on this sacrifice.

Get the complete “Retirement Investment Strategy Checklist” PDF with worksheets, calculators, and action items. This comprehensive resource includes account opening instructions, contribution calculators, and a 12-month implementation timeline. [Download your free PDF guide here – no email required]

The retirement crisis is real, but it’s not inevitable for those who act decisively. Your future self is either thanking you or cursing you for the decisions you make in the next 48 hours. Choose gratitude over regret.

Retirement Investment Strategy Checklist

✅ Printable Worksheet

✅ 12 Month Action Plan

Related Reading: Maximize Your Retirement Success

Continue building your financial knowledge with these essential guides:

- “401k vs IRA: Complete Comparison Guide 2025“ – Discover which retirement account maximizes your savings potential and tax advantages

- “Emergency Fund Calculator: How Much Do You Really Need?“ – Calculate your exact emergency fund requirements based on your personal situation

- “Social Security Optimization: When to Claim for Maximum Benefits“ – Strategic timing guide to maximize your lifetime Social Security income

- “Tax-Loss Harvesting Made Simple: Advanced Strategies“ – Step-by-step guide to reducing your tax burden through smart investing

- “Asset Allocation by Age: Portfolio Strategies That Work“ – Age-specific allocation models for every life stage

- “Roth IRA Conversion Ladder Strategy Guide“ – Advanced tax planning for early retirees and high earners

Frequently Asked Questions

-

Q: What is the best retirement investment strategy for beginners?

Start with your employer's 401(k) to capture the full company match, then open a Roth IRA with low-cost index funds. Automate contributions and gradually increase your savings rate by 1% annually until you reach 15-20% of your income.

-

Q: How much should I have saved for retirement by age 40?

Financial experts recommend having 3x your annual salary saved by age 40. If you're behind, increase your savings rate immediately and consider catch-up contributions if eligible.

-

Q: Should I pay off debt or invest for retirement first?

Always contribute enough to get your full employer 401(k) match first, then focus on high-interest debt (over 6-7%). After eliminating high-interest debt, prioritize retirement savings while making minimum payments on low-interest debt.

-

Q: What's the difference between traditional and Roth retirement accounts?

Traditional accounts provide immediate tax deductions but require taxes on withdrawals. Roth accounts use after-tax contributions but provide tax-free withdrawals in retirement. Choose based on your current vs. expected future tax bracket.

-

Q: How do I calculate my retirement savings needs?

Easy - use our calculator as a guide! Multiply your desired annual retirement income by 25 (based on the 4% rule). If you want $60,000 annually, you need $1.5 million saved. Adjust for Social Security benefits and other income sources.

-

Q: What are the biggest retirement investment mistakes to avoid?

Common mistakes include not starting early enough, failing to capture employer matches, paying high fees, panic selling during market downturns, and not increasing contributions with salary raises.

-

Q: When should I start taking Social Security benefits?

Full retirement age is 66-67 depending on your birth year. You can claim as early as 62 with reduced benefits or delay until 70 for maximum benefits. The optimal strategy depends on your health, financial needs, and life expectancy.

-

Q: How much will healthcare cost in retirement?

Healthcare typically consumes 15-20% of retirement budgets. A healthy 65-year-old couple may need $300,000+ for lifetime healthcare costs not covered by Medicare. Consider long-term care insurance and HSA contributions while working.